A Taranaki accountant had just authorised the transfer of $300,000 to what she thought was a one-year Kiwibank term deposit when she suddenly realised she’d been scammed.

Moments after pressing send, she noticed the recipient account was not a Kiwibank account number but belonged to ANZ.

She tried phoning the so-called Kiwibank investment manager who had called her about a “special” term deposit rate but the number was dead.

Then she noticed his email address was not the standard Kiwibank email format and the bank’s “Helping Kiwis get ahead” logo on his email signature was missing a letter. It read: “Helping Kiwi get ahead.”

Panic set in and she realised she’d just lost her life savings.

“I was like, ‘Oh my God, I’ve just paid 300 grand into a scam’. I felt sick. I was like, ‘I’ve just lost all my money’.”

Though she didn’t know it then, the ANZ account she had sent her money to was allegedly controlled by an Australian national called Ayom Wek.

Police claim Wek, 31, travelled to NZ to open accounts at three different banks then used those accounts to drain nearly $2 million from five unsuspecting Kiwi scam victims in May this year.

Information obtained by the Herald shows the victims all lost hundreds of thousands of dollars, including one who sank $700,000 into the fake term deposit investment scheme.

Police have charged Wek with 34 counts of money laundering and issued warrants for his arrest.

He is currently being hunted by fraud squad officers. A border alert has been issued in case he tries to leave the country, but police believe he is still in Auckland.

If convicted, Wek – who was born in Africa – faces up to seven years in jail.

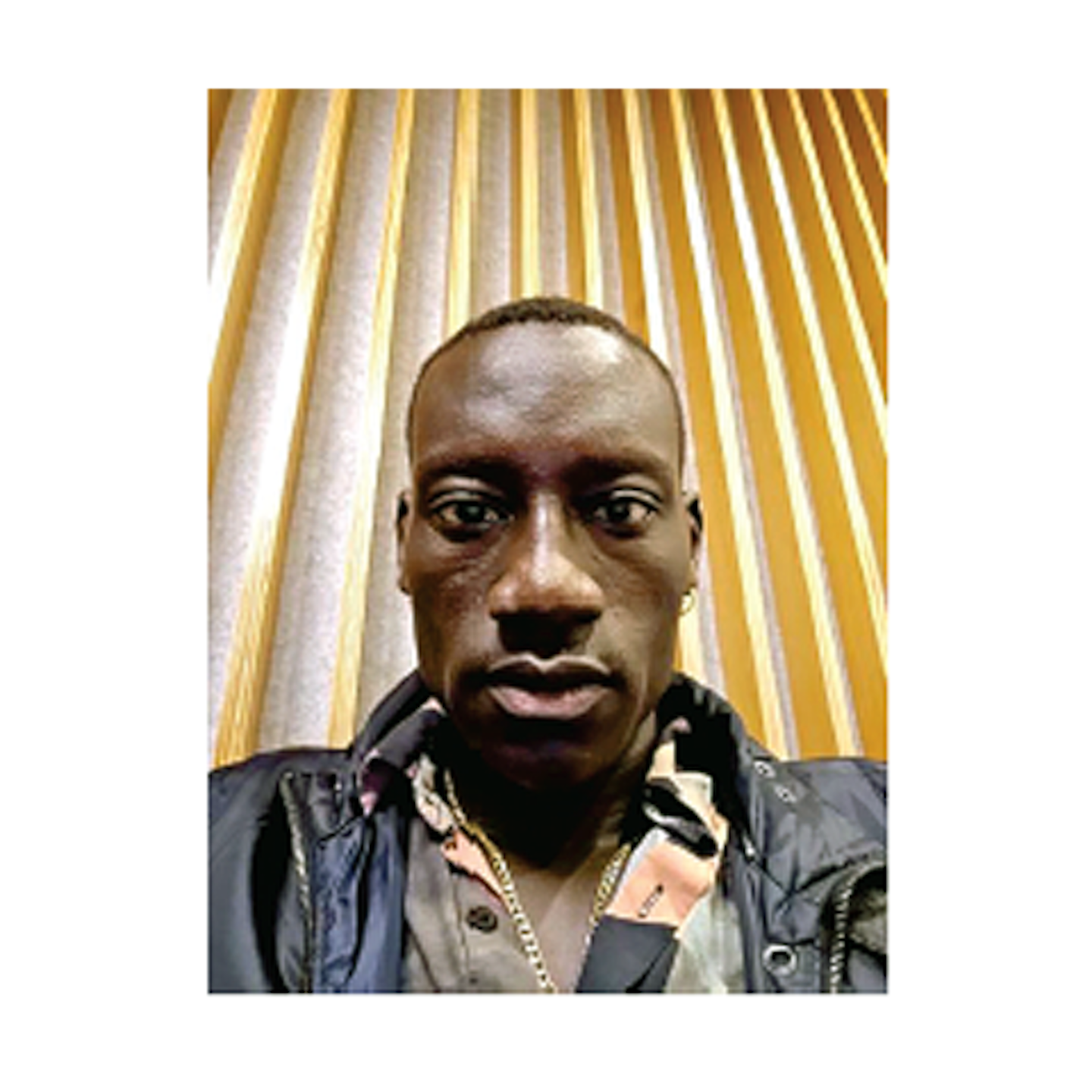

Police claim Ayom Wek, 31, flew to NZ from Australia to set up accounts at three different banks which were used to receive nearly $2 million from five scam victims. There are multiple warrants for his arrest. Photo / NZ Police

The Taranaki accountant told the Herald a term deposit she had with Rabobank was about to mature earlier this year and she was looking online for investment opportunities.

She entered her details on a site comparing term deposit interest rates and was called a few days later by a man calling himself David Weir. He spoke with a British accent and claimed to be a Kiwibank investment adviser.

The man sent her prospectus information and convinced her to invest $300,000 in a one-year term deposit at 7.55% interest.

The accountant transferred the money online on May 20, but on pressing send immediately smelled a rat.

After noticing anomalies with the recipient account, email address and signature, she googled “Kiwibank term deposit scam” and found an FMA warning before realising she’d been duped.

She immediately called Kiwibank and was transferred to the fraud team. They contacted ANZ which put a freeze on the recipient account.

Two days later, $300,000 was returned to the woman’s Kiwibank account after ANZ successfully recovered her money.

After being alerted to the fraud, Kiwibank contacted ANZ, which froze the recipient account and recovered the woman's $300,000.

“I can’t even tell you the relief,” the woman said.

“Thinking for three days that I’d lost everything I’d worked for my entire adult life. You kind of feel like you’ve been given a second chance at life.”

The woman contacted police who told her they believed the man whose account received her money had flown from Australia to open NZ bank accounts.

Though appreciative of both banks’ efforts to recover her money, the woman questioned how an Australian national was allegedly able to open an ANZ account and use it to receive $300,000 as part of an elaborate investment scam.

She also asked what anti-money laundering checks ANZ had carried out when opening the man’s account.

In a statement, ANZ said proper customer due diligence and anti-money laundering requirements were met in setting up Wek’s business account in April, including identity and address verification, and Companies Office checks.

After being alerted to fraudulent activity by Kiwibank on May 20, ANZ blocked the account and suspended all electronic banking. The funds were successfully recovered and returned to Kiwibank.

ANZ refused to say whether it alerted police after learning of potential criminal activity by one of its customers. However, the bank confirmed it provided information to police after receiving a court production order.

Kiwibank said it was happy staff were able to recover the victim’s money before it was received by the scammers.

The bank urged customers to be vigilant for fraud and scams and to contact their bank immediately if they thought they’d been duped.

“Unfortunately, we continue to see frauds and scams targeting Kiwi increase, both in number and complexity. We’ve committed to ongoing investment in our fraud detection and prevention systems to keep our customers safe.”

The victim said she considered herself to be cautious and conscious of scam risks, both personally and through her profession.

“So based on my personal character of being quite cautious and being aware of things and erring on the side of ‘don’t trust anybody’, how did this happen to me? It makes me feel like an absolute numb nuts.”

Lane Nichols is a senior journalist and deputy head of news based in Auckland. Before joining the Herald in 2012, he spent a decade at Wellington’s Dominion Post and the Nelson Mail.

Take your Radio, Podcasts and Music with you