Everybody in the business community read Brian Gaynor.

Stockbroker, sharemarket analyst, co-founder of Milford Asset Management and long-time Herald and BusinessDesk columnist - he was an enormous presence in the New Zealand business community for more than 30 years.

Gaynor, who died this morning after a brief illness, was a fearless champion for New Zealand companies and the local sharemarket.

He pushed back against foreign takeovers, often sticking his neck out to oppose offers when it looked like there was big money left on the table.

That New Zealanders undervalued themselves and their companies was a constant theme in his writing. He urged Kiwis to take a longer investment horizon.

From the sale of Lion Nathan, the break-up of Fletcher Challenge to the attempts to buy Auckland International Airport and Infratil, Gaynor was in the thick of it all.

As a journalist and a writer Gaynor had a remarkable capacity for research and a memory for business events that few could rival.

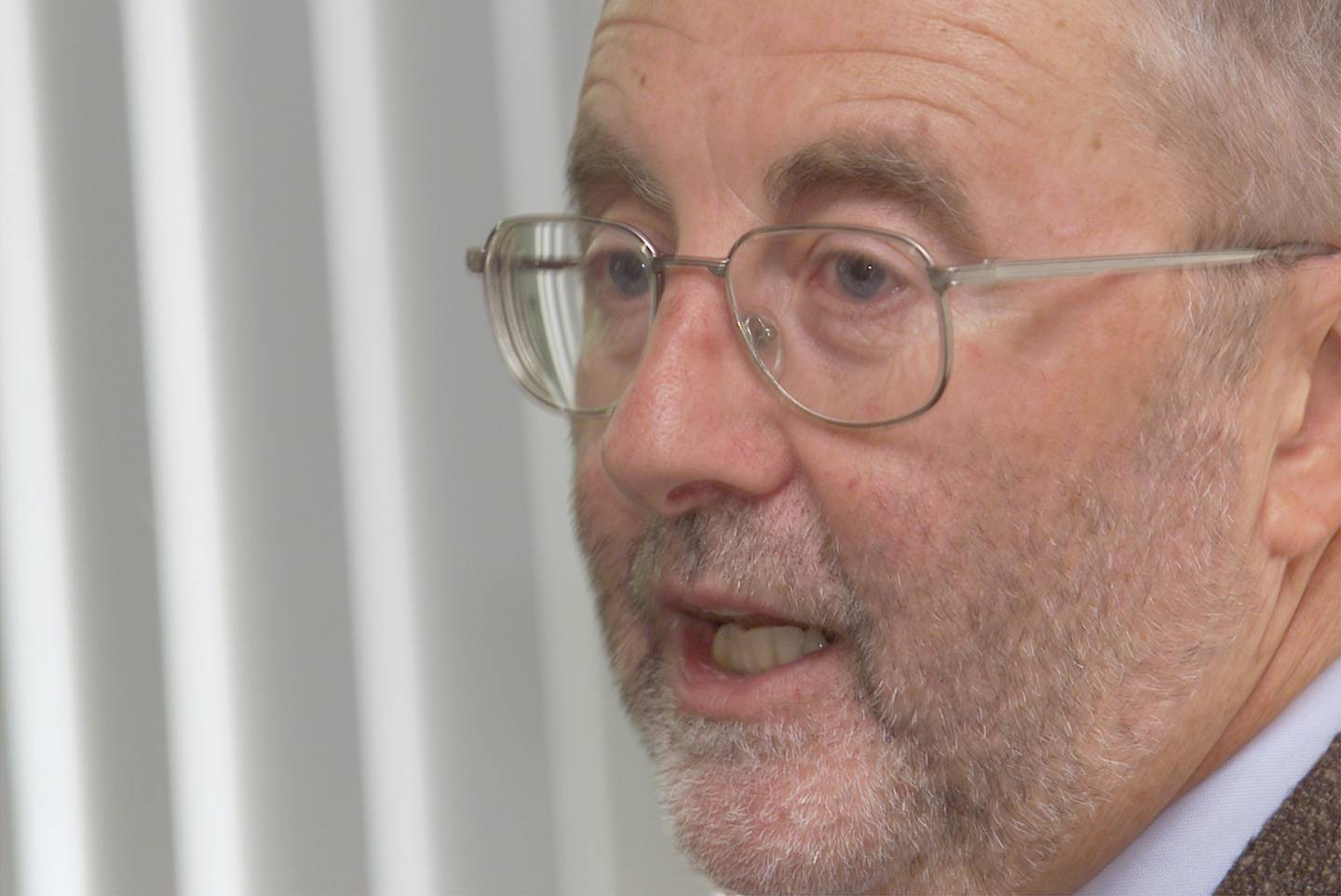

Wherever he spoke Brian Gaynor would captivate audiences. Photo / Supplied

His columns were about building the strongest possible argument, laying out all the facts before delivering a verdict often in the final paragraphs.

But his wry Irish wit was always lurking just below the surface.

In his final column for the Herald in 2019 he noted his own commitment to two core principles. The first was never to miss a deadline, because he felt he might lose his position to another writer - even though he was in such a class that this was never a possibility.

The other principle was to never use the words "I" and "me". He was determined to keep his ego out of the story and let the facts speak for themselves.

He kept the Herald's lawyers busy with a passion for truth and plain speaking.

In the aftermath of the Global Financial Crisis, Gaynor spoke bluntly about the failings of local finance companies.

Brian Gaynor speaking at the New Zealand Shareholders Association inagural meeting in 2004. Photo / Paul Estcourt

Gaynor was wary of market bubbles and investment hype in all shapes and forms.

He learned lessons in the 1987 sharemarket crash that he carried with him through his career.

"People didn't believe the sharemarket would fall in the 80s," he told the Herald in 2016. "I'd come in from a trip to Australia and the guy at Customs wouldn't let me in unless I gave him sharemarket tips. It was just euphoria."

He played a key role in the improved regulatory environment that emerged from the wreckage of 1987 and eventually the reforms that were put in place after the GFC.

In 2003, Gaynor co-founded Milford Asset Management, which quickly gained a following among high-net-worth investors.

The business took off following the launch of the portfolio investment entity (PIE) and KiwiSaver regimes in 2007, establishing a series of unit trusts, including the flagship Active Growth Fund, managed for many years by Gaynor.

Milford funds have been consistent top-performers since launch, while the Milford KiwiSaver scheme, launched in 2010, now boasts about $15 billion under management and a swag of industry awards.

Brian Gaynor takes the floor at an annual shareholder meeting. Photo / David White

Gaynor was awarded New Zealand Shareholders' Association's prestigious Beacon Award twice – once in 2006 and again in 2020.

In his speech accepting the award in 2020, Gaynor noted that he had been observing the NZ capital markets for 44 years and that he divided that time into two periods: pre-2001 was "the Dark Age" and since then "a More Enlightened Age".

Prior to founding Milford in 2003 his career included roles as a partner and head of research at stockbrokers Jarden & Co, a member of the New Zealand Stock Exchange, chairman of the New Zealand Society of Investment Analysts and chairman of the Asian Securities Analysts Council.

In 2011, Gaynor tragically lost his teenage son David. He is survived by his son Peter and wife Anna.

Take your Radio, Podcasts and Music with you