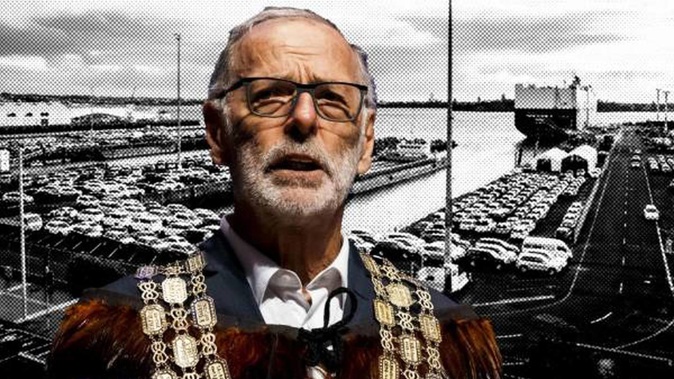

Auckland mayor Wayne Brown says it is now the turn of local boards to join council-wide cost-cutting in the face of its near $300 million budget hole.

A day after proposing selling the council’s stake in Auckland Airport – which he said could raise almost $2 billion – Brown has asked all elected members, including local boards, to do their part in trying to plug the forecast $295m budget shortfall.

Brown’s 2023/24 budget proposal is seeking record savings of $130m across Auckland Council and council-controlled organisations (CCOs).

That includes Auckland Transport, Tataki Auckland Unlimited and Eke Panuku Development Auckland.

Brown confirmed on Saturday he will ask local boards to find 5 per cent in cost savings from their total annual funding of $298m when the 2023/24 budget proposal is put to the governing body next week.

“Things are tough for everyone right now,” he said.

“Our local boards will have to play their part in the hard work being done to bridge this budget hole and create a sustainable financial path for the future.

“When the fiscal burden of the next financial year is behind us, I will be recommending that more funding and more decisions be controlled by local boards than ever before.”

Brown said he will be asking local boards to work collectively to decide how best to achieve these savings.

That could be via a combination of reduced spending on locally driven initiatives (LDIs) and asset-based spending, postponed spending on assets and administrative efficiencies.

Brown emphasised his commitment to real decisions being made by council committees and the local boards closest to the communities that are affected by them.

In a statement, he said “ideally” he would like local boards, via a long-term plan, to be given clear budgets for their communities, have the sole power to decide how to spend it, and have the sole political and legal accountability over funds and decisions.

While he said some progress had been made by the previous council to empower local boards, he stressed “we need to go further and faster”.

On Friday, Brown spoke of the proposal to sell Auckland Council’s Auckland Airport shares.

The sale could reduce debt servicing to ratepayers by at least $88m annually, Brown said.

He added the sale of the council’s take in the airport – which is its largest financial holding – could cut next year’s rates rise by nearly a third.

Based on Thursday’s closing price, Auckland Council’s 18 per cent stake is valued at $2.166b.

The sale of the minority shareholding is part of Brown’s 2023/24 budget proposal.

“Next year, Auckland ratepayers are set to fork out $88m in debt servicing costs to maintain a non-controlling shareholding,” Brown said.

“With interest rates rising, the cost of debt servicing could soon reach $100m a year for ratepayers.

“Over the last three years, ratepayers have paid $240m in debt servicing costs to hold a bunch of shares that haven’t paid a cent in dividends. The cost of holding these shares exceeds any return, and forecasts suggest this situation will not be reversed for Auckland Council as a shareholder in the foreseeable future. There are better uses for ratepayer capital.

“If the airport needs additional capital for new projects, Auckland ratepayers could be asked to stump up extra cash or see our ownership stake fall even lower.

“Every cent we raise from the sale of the 18 per cent minority stake would be used to lower net debt. The money we save from debt servicing in 2023/24 will be used to reduce rate rises by about a third from levels feared and, in 2024/25, priority will be given to help support new initiatives for local boards.”

Take your Radio, Podcasts and Music with you